To explore the case for Monero today, we need to begin with a brief history of Bitcoin and the implications of its’ invention. Bitcoin is attempting to solve some of the most significant problems of our day, but by exploring its similarities and differences with Monero, we will see there is an argument to be made that Monero is the superior technology as we move further into the information age. While the breakthroughs brought to us by Bitcoin are not to be discounted, it is becoming increasingly clear that there are real threats to preserving the original purpose of this revolutionary technology. The fundamental question of years to come may be this: what will be valued more – digital scarcity or digital privacy? Is it possible to achieve both?

In the most simple terms Bitcoin is a new form of money, however this simple description does not even begin to scratch the surface of its’ value proposition or implications. Language falls short here much in the way someone from the late 19th century who was familiar with the concept of electricity would struggle to describe the invention’s implications to someone unfamiliar. Bulbs that emit light and eliminate the need for oil lamps? Most would receive that with skepticism. In 1880 Henry Morton, a prominent mind of the time, said anyone familiar with Edison’s invention could only conclude that it would be a failure. In that same vein economist Paul Krugman famously quipped in 1998 that the internet’s effect on the economy would be about as significant as the fax machine. Many new breakthroughs fail to successfully seed in our minds because we cannot fathom the effects of such groundbreaking inventions since we do not have an existing framework in our minds to understand the potential. This is the same pitfall with describing Bitcoin and thus Monero; there simply has never been anything that existed in human history that would provide us a reference point from which to describe it.

To appreciate Bitcoin’s disruption to our collective understanding of money we have to consider the question: what is money? Have you ever critically considered what those digital numbers are that directly deposit into your bank account? Is cash money? These are tough questions when you consider their depth. The story of what money “is” is a bit complex. Going back to ancient history we can find gold, other precious metals, and organic materials that served as money because they were collectively agreed upon by societies that they hold intrinsic value. Once these things are assigned value they can be used as mediums of exchange and stores of value. Gold is an example of this type of material still used today.

Over time new forms of money emerged into concepts we are more familiar with today such as cash and coins. This evolution was mostly the result of making commerce easier – it is more efficient to transact in cash, notes, or dollars than lugging gold around everywhere. But regardless of the implementation all of these different forms of money had one thing in common. Each type held value because it carried with it a guarantee to a valuable underlying asset. For example, in the early twentieth century US dollars were backed by the promise to receive a set amount of gold in return for those dollars. This concept is outlined exceptionally well in the book Layered Money by Nik Bhatia.

The US Dollar we know today has a long history that involves many changes driven by our approach to central banking and the actions of the Federal Reserve. Throughout the twentieth century there were various economic drivers that made gold convertibility for dollars a problem, eventually leading to suspension of this convertibility by the US government in 1971. What we are left with today is essentially a US Dollar that functions as a reserve currency in itself; there is no underlying layer of asset or commodity of higher value.

Why is this a problem? Let’s use the United States Federal Reserve system as an example, which exists as a safety net in times of crisis. During the financial crisis of 2008 the Federal Reserve needed to be able to withstand the storm, but without sufficient real reserve assets, there was nothing left to do but implement what we have come to know as Quantitative Easing (QE) lest they let the economy suffer serious harm. At the risk of sounding oversimplified, another way to explain QE is just government creating more money. The financial crisis of 2008 and subsequent instability that we are still experiencing demonstrates that the financial system as we know it in the US cannot continue to survive without continuing quantitative easing policies.

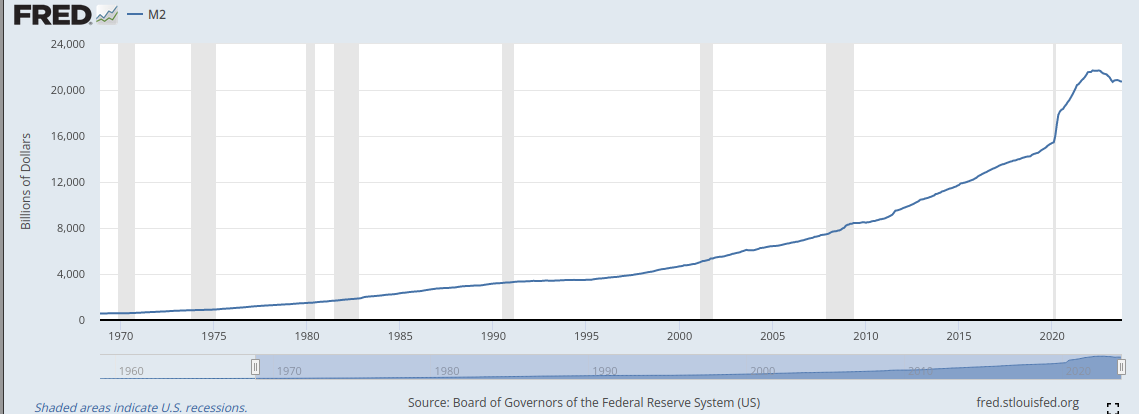

US money supply over time:

This process of injecting money into the system in perpetuity creates a problem that Bitcoin attempts to solve: inflation. When more US dollars are created, our purchasing power is weakened. That means average people are able to obtain less for the money they’ve worked to earn. Purchasing power of the US dollars you hold has recently reached record lows. This is because more dollars being created equals diluted value. Things like gold are valuable precisely because they are scarce and not easily obtained, not because they can easily be created by governments.

The main point here is that within inflationary environments you want to own something scarce to preserve your net worth against a currency fading in value. A rallying cry among Bitcoin enthusiasts is that there “will only ever be 21 million Bitcoin produced”. This is core to the code running the Bitcoin software: it is programmed digital scarcity. It is inherently scarce thus securing its status as a store of value while also ensuring price appreciation over time as less and less Bitcoin are available. There is no central authority that can decide to change this. Saving in Bitcoin instead of US dollars has the potential for allowing the fruits of your labor to not deteriorate over time due to the whims of public policy and central bankers. It is prudent to save money in an asset that has predetermined fixed scarcity versus a government currency subject to uncertain amounts of manipulation and a seemingly steady rate of increased quantity and subsequent dilution.

Bitcoin is a first of its kind application of blockchain technology that allows for a chronological record of transactions to be recorded through a computational proof of work concept. Proof of work ensures that it is nearly impossible for bad actors to reverse transactions or generate fraudulent transactions. It would be computationally impractical to attempt an attack like this and require an incredible amount of resources. This system allows for secure and trusted financial transactions to occur without the need of a third party to verify authenticity. The complex computation performed by miners negates the risk of fraud while the ability of anyone to keep a copy of the blockchain (via running a node) ensures immutable transaction records are available 24 hours per day and globally distributed. This ledger is like a digital chain that keeps growing every few minutes with a perfect record of all transactions in each individual block since Bitcoin started. This ability of Bitcoin lays the groundwork for a global decentralized financial system.

But are there problems with this Bitcoin thesis? I argue that two primary issues are emerging.

1. Digital scarcity achieved at the expense of capture by traditional finance.

Since its inception in 2009, Bitcoin has experienced price appreciation (in fiat terms) at an impressive scale. Bitcoin was the best performing asset of the decade during the period ending in March of 2021 with a return of over 230%. Its success in producing returns for investors has garnered a lot of attention from traditional finance institutions and has created a sea of new business models trying to capitalize on this momentum. It is fair to say that Bitcoin has reached the mainstream lexicon of today; it is rare to encounter someone in the developed world who has never heard of it in 2023. While attention like this is positive for investors and businesses (like exchange platforms), it can be argued that there is an (albeit unintended) effect this has on the original design intentions of Bitcoin. As Satoshi outlines in the famous whitepaper, Bitcoin was intended to be a peer to peer electronic cash system. With continual focus on the rising price, traditional finance adoption, and constant news cycles about Bitcoin Exchange Traded Funds (ETF) it is beginning to feel that Bitcoin will function more as a volatile tech stock than it will be an everyday medium of exchange or cash note equivalent. While there is always an attempt to change this narrative, Bitcoin has responded very much in line with the rest of the traditional finance sector including 2023’s price rise where “…everything rallied, including bonds, which had their best returns since 1980, and bond ETFs,”.

A vital quality of a cash like system is peer to peer exchange which is fundamentally discouraged by most Bitcoin proponents because the value proposition of the protocol has shifted to a means to save (“number go up”). To be clear, an asset that allows for the preservation of your wealth against government issued currency debasement is a very valid use case. However, we can conclude that this only leads to hoarding behavior on the part of the consumer as the value of the asset in their possession continues to grow. This is at the core of the “Hodl” mantra. Rather than spend Bitcoin in the economy like currency, trading has become the predominant purpose of the protocol which can lead to issues of market manipulation by those with the means. Monero in contrast encourages peer to peer exchange with dynamic block sizes, privacy by default, and less exposure risk to market manipulation due to lack of exchange listings. While many may view the refusal of some cryptocurrency exchanges to list a Monero trading pair as a negative, this is actually a sign of a functional and disruptive peer to peer electronic cash system. If an electronic cash protocol is working successfully then it is perfectly logical that it should primarily operate outside of the confines of traditional markets. Bitcoin has stopped being dangerous in this way; existing power structures have discovered a way to profit off of the very technology that was supposed to disrupt conventional banking and the corruption of financial elites. Lastly for something to act like cash, there should be relatively low swings in price to provide stability when used as a medium of exchange. Monero is clearly the better choice here - scoring lower than 86% of other cryptocurrencies in a volatility index.

2. A faux permissionless system.

A central tenant of Bitcoin is that there should be no barriers to participation in the network, however we have seen examples over time of this being a problem. A recent post from a core developer highlights a case where it is very likely that miners purposely excluded blocks based on the transaction addresses involved being sanctioned. It is very likely in the future that we will only see more sanctioning behavior caused by the transparency of the Bitcoin blockchain. Government institutions will need to expend little effort to identify and block transactions of addresses they deem to be a problem. While confirmed illegal activity can and should be acted upon, there can be no guarantees on what your government may one day decide to censor. With the rise of mass digital financial surveillance and the decline in use of physical cash, it is easy to see a future with very little privacy in your day to day expenses. This can be even more apparent with the advent of Central Bank Digital Currencies (CBDC) – a topic worthy of its own blog post.

This is where Monero excels as a protocol dedicated to providing users privacy by default. “Monero users reap all the benefits of a decentralized trustless financial system, without risking the security and privacy downsides of a transparent blockchain” (SerHack, 2018). In an age where threats to digital privacy are ever increasing, Monero exists to fill the void left by big tech’s dragnet on humanity. If a world of stringent financial surveillence and high pressure on physical cash use, you don’t want to be stuck transacting with tainted money.

The overall conclusion is that if your primary interest in a digital currency is to trade, Bitcoin is likely the better option. However there are no future guarantees on how you will be able to interact with the network given it’s transparent nature and vulnerability to censorship. Institutional adoption and new financial products will only bring more scrutiny, regulatory pressure, and opportunities for tax revenue. Essential components of the network have clear susceptibility to gate-keeping behavior. On the other hand, if you believe in the mission of creating permissionless electronic peer to peer cash, Monero is the clear winner. It provides for an uncensorable foundation that is resistant to capture. In a time where global economies are heading in an uncertain direction and privacy is eroding, governments will be keen to know where and how much you are spending. It would be wise to have some alternative currency that is scarce, anonymous, and built for the digital age.